For many, having a house marks a major turning point. Still, realizing this ideal calls for very meticulous budgeting and financial preparation. Here is where the banking app finds applications. Our financial management has been changed by these digital technologies, which also make saving for a down payment and other homeownership costs simpler.

Simplifying Your Financial Tracking

The ability of banking apps to accurately track your income and expenses is one of its main advantages. Organizing your spending will help you find places where you might cut back and direct more money towards your house buying objectives. To keep on target, some programs even include budgeting tools and spending notifications.

Prepared for a down payment

Your mortgage interest rate can be much changed by a large down payment. App for banking make it easy to arrange automatic savings transfers. You can set aside a certain amount every month or commit a portion of your salary straight to your savings account. Automating the process helps you to stay closer to your savings goal.

Investigating Housing Alternatives

Many banking applications let you investigate several loan choices and compare interest rates by partnering with mortgage lenders. This will enable you to locate the ideal mortgage offer for your financial circumstances. Some of the offer features to project your monthly mortgage payments, therefore guiding your decision on budget range.

Homeownership Expenses: Budgeting

Having a house comes with expenses beyond just the mortgage pay-off. These costs—from utilities and upkeep to property taxes and homeowners insurance—can mount rapidly. By helping you to construct a comprehensive budget including all of these expenses, banking applications guarantee your financial readiness for homeownership.

Creating a Safety Fund

Anybody who owns a house needs an emergency fund. Unexpected costs including medical bills or house repairs can strike at any moment. By letting you define different savings objectives, banking applications can enable you to set away money for an emergency fund. Try to save between three and six months’ worth of living costs.

Building the Value of Your House

Although they have nothing to do with budgeting, an app for online banking can also assist in house value investment. Certain apps let you track local home values, thereby helping you to keep an eye on market changes. You can also look at possible house renovation projects and their expected pay-off on investment.

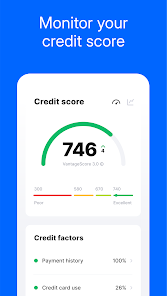

Managing Your Credit Score

A decent mortgage rate requires a solid credit score. Many times, banking applications give access to your credit score and report so you may keep an eye on your financial situation. Understanding your credit score will help you to take action to raise it, like paying bills on time and cutting credit card debt.

Creating Objectives for Finance

Apart from saving for a down payment, banking applications chime can assist you to create and meet other financial goals. You might set certain savings targets for house furniture, relocation expenditures, or closing charges. Monitoring your development helps you to keep on target and motivated.

Conclusion:

Ultimately, for budgeting and saving for a dream house, banking apps have evolved into essential tools. Using the tools these apps provide will help you to track your development, manage your money, and reach your house ownership targets. Recall that realizing your dream of property depends mostly on regular saving and budgeting.