In today’s turbocharged world, having instant access to funds is like holding the key to financial flexibility. Whether you’re facing a surprise medical bill, a home repair emergency, or an unmissable business opportunity, instant personal loans have come to the rescue, transforming the lending game altogether. In this exhilarating blog post, get ready to dive headfirst into the world of instant online loans, discover their incredible perks, and witness how they’ve turned traditional lending on its head.

1. Unraveling the Mystery of Instant Online Loans:

Prepare to be amazed by the magic of instant online loans! These turbocharged borrowing options are designed for speed and convenience and are accessible with just a few clicks on your trusted online platform. Say goodbye to the days of laborious paperwork and lengthy approval processes. Instant online loan app boast a streamlined application journey, minimal eligibility requirements, and lightning-fast approvals that can materialize within minutes or hours. The loan amounts available vary depending on your lender and creditworthiness, ensuring a tailored experience.

2. Igniting Your Financial Freedom with Instant Online Loans:

a. Speed and Convenience: Buckle up for a ride where speed and convenience reign supreme. Instant online loans obliterate the need for tedious paperwork and tiresome visits to brick-and-mortar institutions. You can apply for a salary loan from the comfort of your home at any hour of the day or night. The digital process guarantees a swift response, quickly empowering you to tackle your urgent financial needs.

b. Accessibility: Instant online loans are all about inclusivity. They embrace a wide range of individuals, even those with less-than-perfect credit scores. Many lenders consider alternative credit scoring models, considering factors beyond your conventional credit history. It’s a breath of fresh air that opens doors for those who might have faced rejection from traditional lenders.

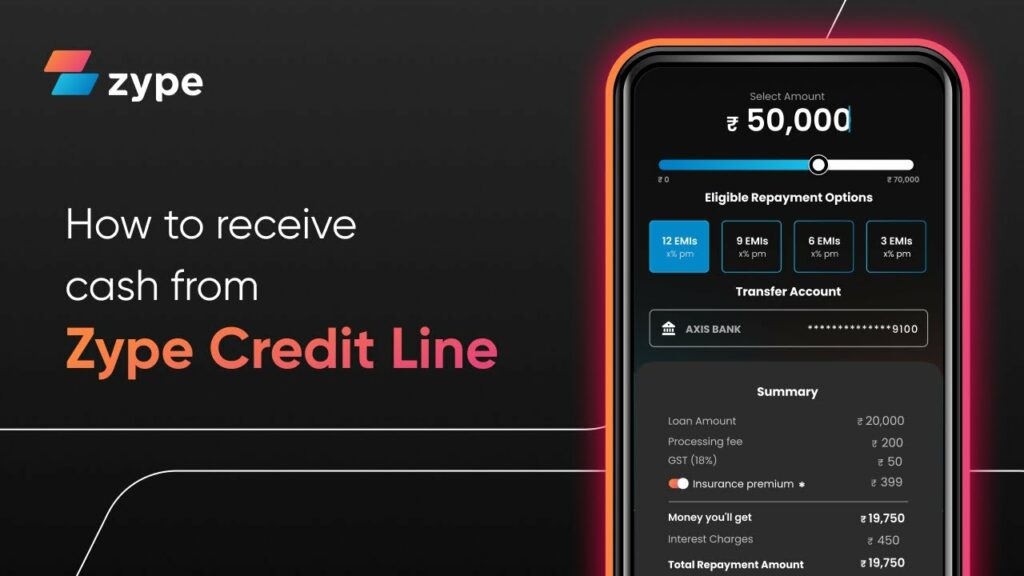

c. Flexibility: Get ready to customize your financial destiny! With instant online loans, you’re in control. Tailor your loan terms, including the amount and repayment duration, to match your unique circumstances. This flexibility ensures that your easy emi loan aligns perfectly with your financial situation, preventing unnecessary burdens and paving the way for a manageable repayment process.

3. Navigating the Waters: Risks and Considerations:

As you embark on your instant online loan adventure, it’s essential to navigate the waters with caution, considering the following factors:

a. Interest Rates and Fees: Prepare for potential challenges, such as higher interest rates and fees associated with instant online loans. Always look into the terms and conditions, ensuring you’re comfortable with the repayment commitments.

b. Responsible Borrowing: While accessibility is a gift, it comes with a responsibility. Use instant cash loan for emergencies or well-planned expenses rather than frivolous or unnecessary purchases.

c. Credible Lenders: With instant online loans becoming increasingly popular, choose your lending companions wisely. Seek out reputable lenders who adhere to ethical lending practices. Conduct research, explore customer reviews, and verify licensing and regulatory compliance.

Conclusion

In a world where time waits for no one, instant online loans have emerged as the ultimate solution, granting individuals accessible and efficient access to crucial funds. By harnessing technology and simplifying the borrowing process, these loans offer the flexibility and convenience required to tackle immediate financial needs. But remember, a responsible approach, a firm grasp of the terms, and trustworthy lenders are the key ingredients for a positive borrowing experience. Embrace the power of instant online loans, unlock financial stability, and seize the opportunities ahead!